As we enter the new year, it is always interesting to see how the landscape of the UK residential market has shifted. And this year’s rankings have shown a clear diversification, bringing exciting changes and opportunities for both buyers and sellers alike.

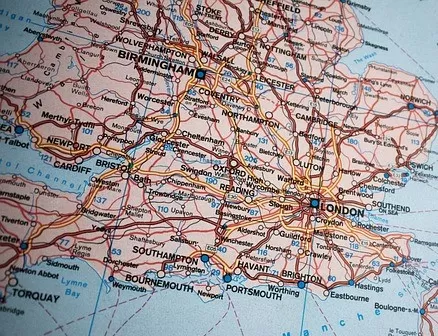

One of the most notable shifts in the rankings is the rise of regional cities. Gone are the days where London dominated the top spots, with cities like Manchester, Birmingham, and Edinburgh making their way up the list. This diversification not only brings a fresh perspective to the market, but also provides investors with a wider range of investment options.

For years, London has been seen as the ultimate destination for property investment. Its status as a global financial hub and its high demand for rental properties have made it an attractive choice for investors. However, the pandemic has highlighted the importance of work-life balance and has prompted many to search for properties outside of the bustling capital.

This shift towards regional cities is not surprising, considering the numerous benefits they offer. For one, they provide more affordable options for both buyers and renters, with properties often being priced at a fraction of the cost compared to London. In addition, they offer a better quality of life, with less congestion and a stronger sense of community.

Take Manchester, for example. This vibrant city has seen a significant increase in demand for properties, thanks to its booming job market and its unrivaled cultural and social scene. Its strong transport links and affordable housing prices have also made it an ideal location for young professionals and families alike.

Similarly, Birmingham has experienced a surge in popularity, with its ongoing regeneration projects and its position as the UK’s second city. Its central location, excellent transport links, and affordable property prices make it an attractive choice for those looking to invest in the UK residential market.

Another factor contributing to the diversification of the UK residential market is the rise of Build to Rent (BTR) properties. These purpose-built rental properties are gaining popularity, offering tenants high-quality, fully-furnished apartments with added amenities such as gyms, communal areas, and concierge services.

BTR properties have the potential to provide a stable and lucrative investment opportunity, with the demand for rental properties expected to continue rising in the coming years. This diversification in the market not only benefits investors, but also provides tenants with more options and a higher standard of living.

Moreover, the growing popularity of BTR properties also highlights a shift towards a more tenant-centric approach in the residential market. With more focus on providing quality rental options and building long-term relationships with tenants, this could lead to a more sustainable and stable market in the future.

Another trend that has emerged in this year’s rankings is the growth of eco-friendly properties. With a greater emphasis on sustainability and reducing our carbon footprint, properties with green features such as solar panels, energy-efficient appliances, and green spaces are becoming increasingly popular.

Not only do these eco-friendly properties benefit the environment, but they also offer long-term cost savings for homeowners. This trend is expected to continue, with the UK government setting ambitious targets to achieve net-zero carbon emissions by 2050.

Furthermore, the pandemic has accelerated the digital transformation in the residential market. Virtual viewings, online mortgage applications, and digital property management have become the new norm. This has not only made the process of buying and selling properties more efficient, but also more accessible to a wider range of buyers.

In conclusion, this year’s rankings have shown a clear diversification in the UK residential landscape, with regional cities, BTR properties, eco-friendly homes, and digital advancements taking center stage. These changes not only offer new opportunities for investors and buyers, but also pave the way for a more sustainable and tenant-centric market. As we look towards the future, it is exciting to see how these changes will continue to shape the UK residential market and provide a dynamic and diverse landscape for all.